Pre-feasibility Study

The January 2023 independent NI 43-101 Pre-feasibility Study (“Technical Report”) was prepared by USA-based engineering firm RESPEC Company LLC (“RESPEC”) for West Vault’s 100% owned Hasbrouck Gold Project located near Tonopah, Nevada.

The Technical Report updates a September 2016 Pre-feasibility Study (“2016 PFS”), necessary because of the effects of increased capital costs, operating costs, and metal prices on project economics and on Mineral Resources and Mineral Reserves. After completing the Technical Report, it has been determined that the mine plan, mineral processing, and Mineral Resource and Mineral Reserve Statements are substantially unchanged from the 2016 PFS. Exploration and expansion potential on the fully permitted project is highlighted.

The Technical Report was prepared largely by the same team that prepared the 2016 PFS, headed by RESPEC (formerly Mine Development Associates) of Rapid City, South Dakota, with contributions from Kappes, Cassidy & Associates, Reno (“KCA”), NewFields Mining Design & Technical Services (“NewFields”), Jorgensen Engineering & Technical Services (“JE&TS”), and Westland Engineering & Environmental Services (formerly EM Strategies).

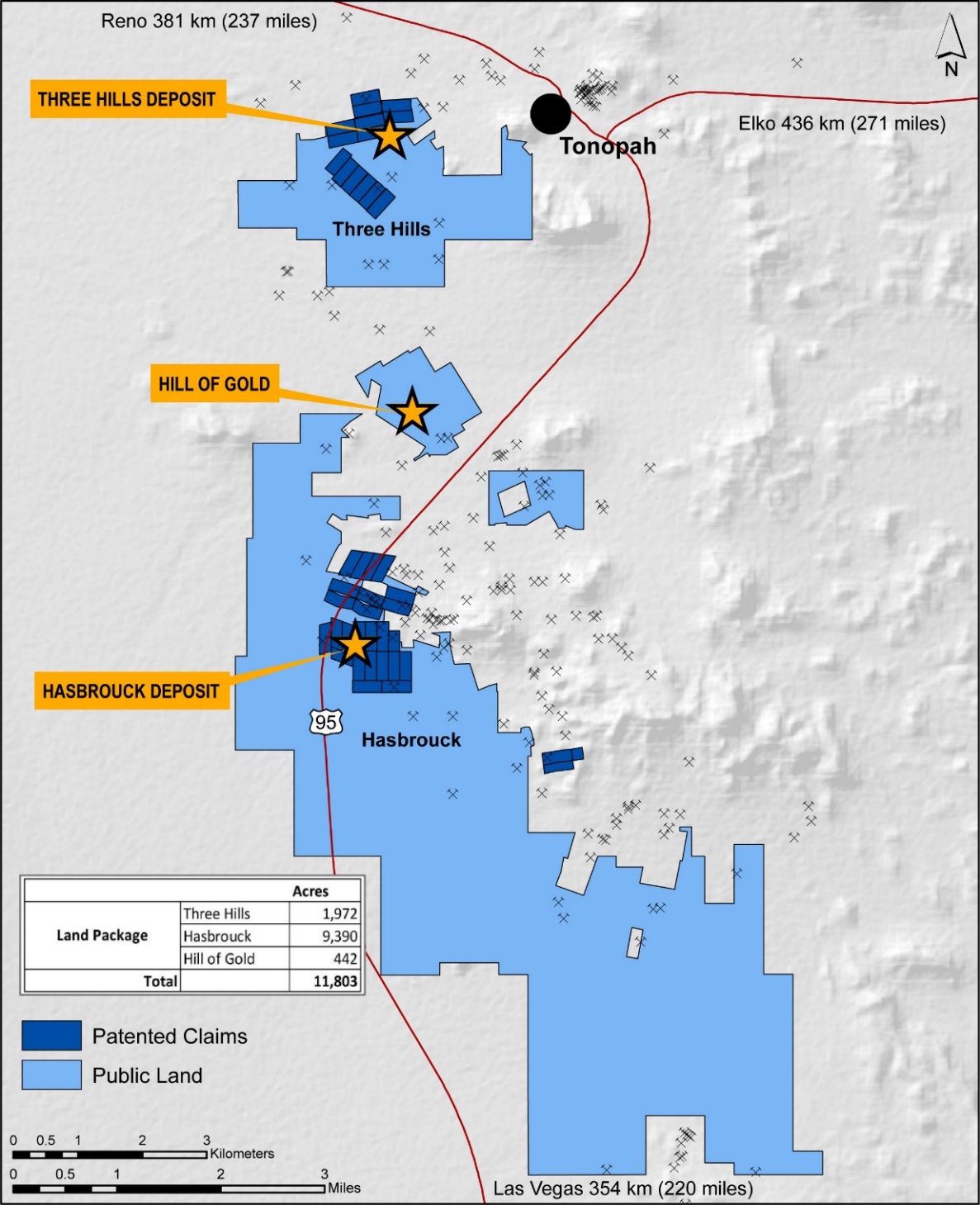

The Hasbrouck Gold Project consists of the Three Hills and Hasbrouck Deposits plus a large land package, located near Tonopah, Nevada. All dollar values presented in this website presentation are in U.S. dollars.

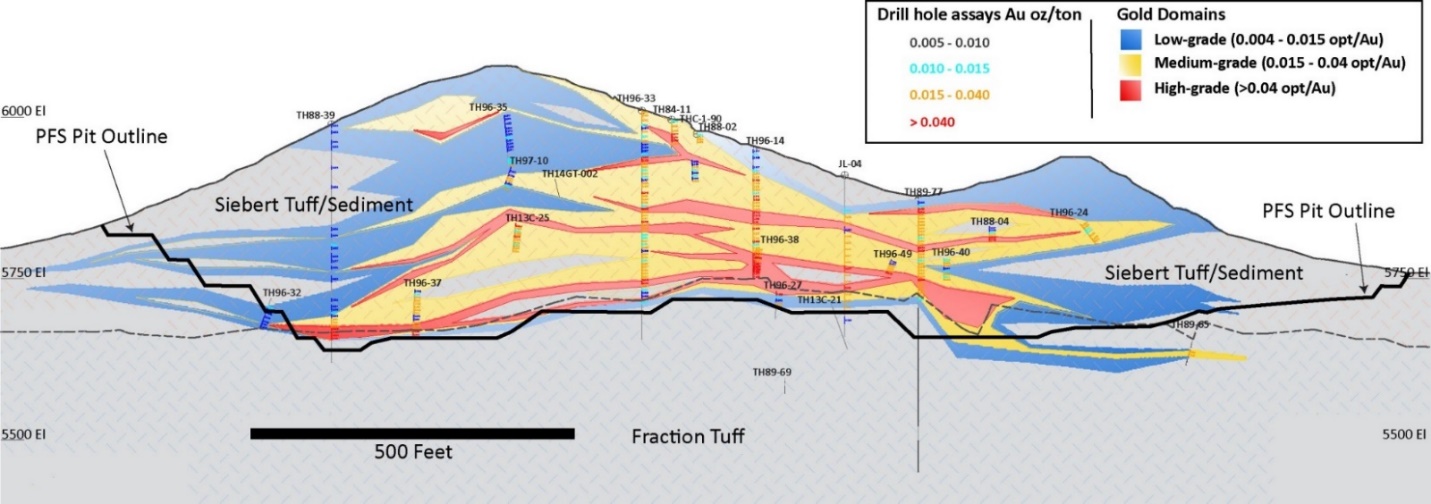

Three Hills Deposit

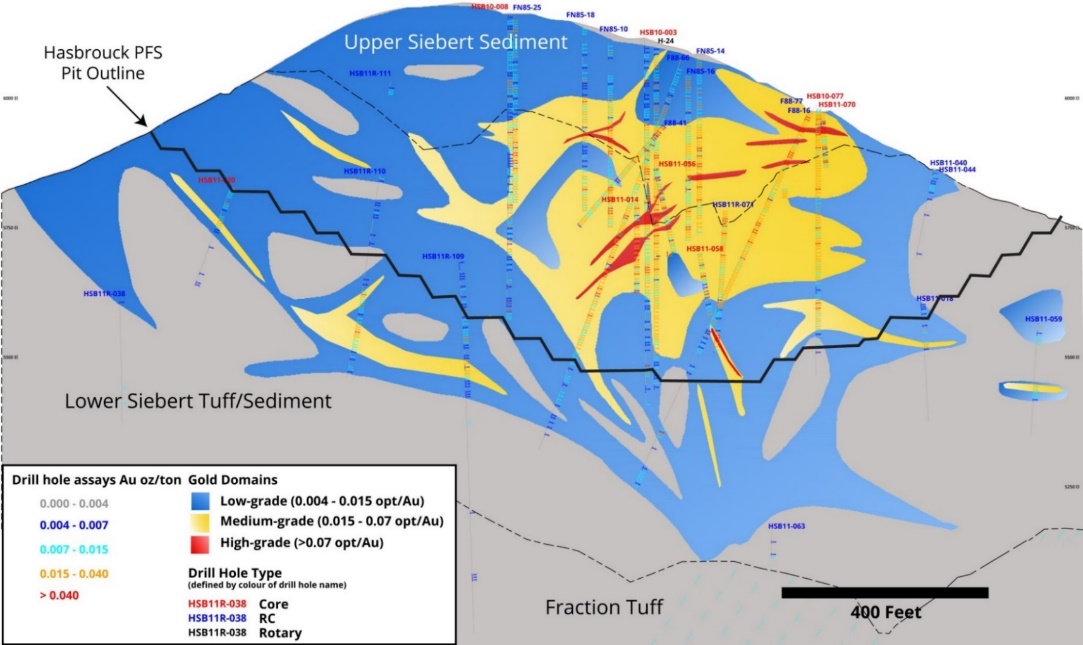

Hasbrouck Deposit

Overview Map

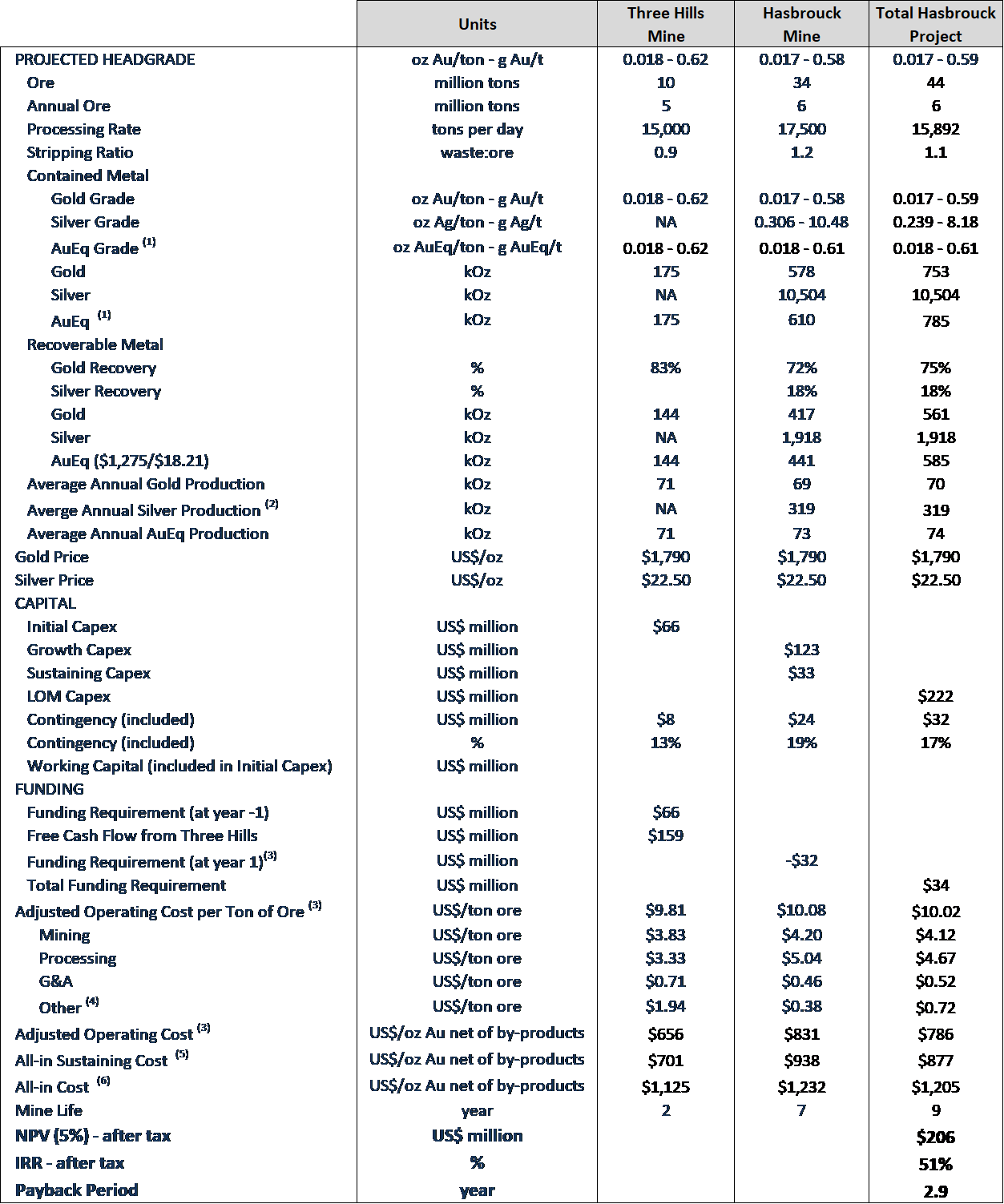

2023 Technical Report Highlights (2016 PFS at $1,275 gold in brackets)

| Project Status | Permitted, construction-ready |

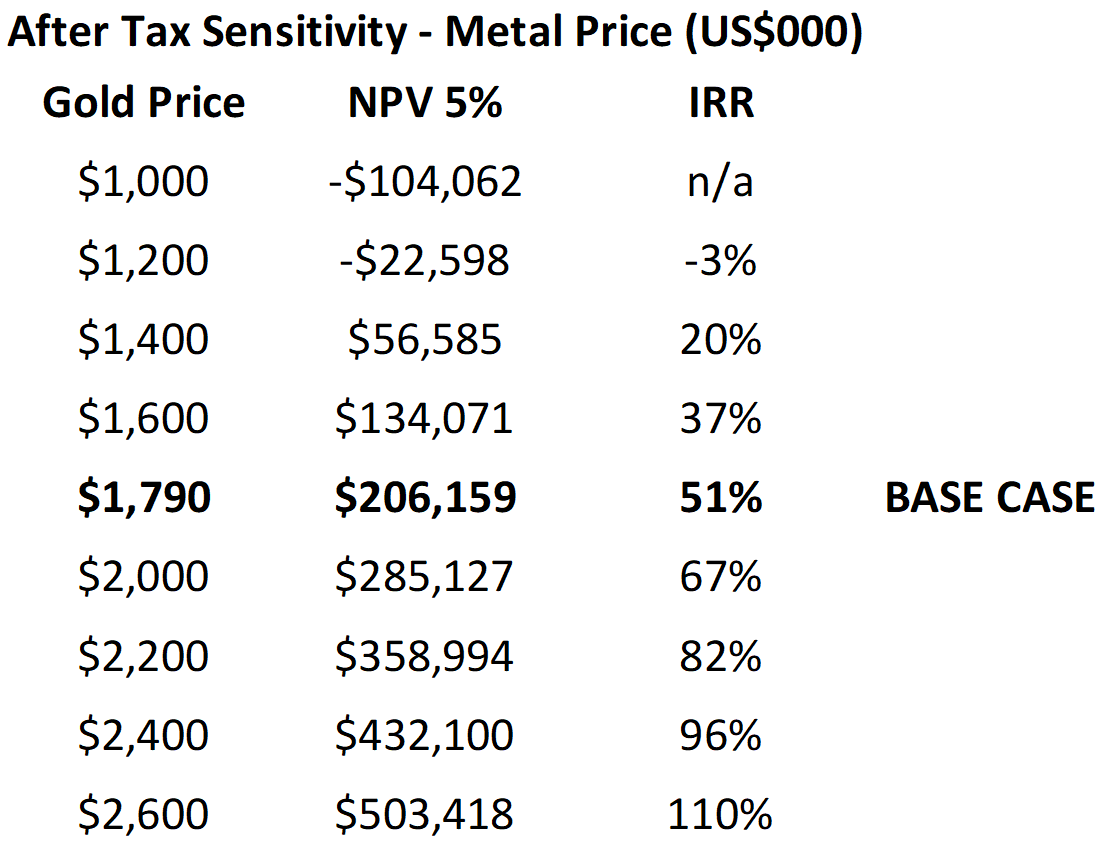

| NPV(5%) (after-tax, $1,790 gold) | US$206 million (US$120 million) |

| IRR (after-tax, $1,790 gold) | 51% (43%) |

| Initial Capital | US$66 million (US$47 million) |

| Pay-back | 2.9 years (3.1 years) |

| Recoverable Gold & Silver | 561 koz gold (577 koz); 1,918 koz silver (1,163 koz) |

| All-in Sustaining Cost | US$877 per gold ounce net of by-product credits (US$709) |

| Geology | well-understood, +600 boreholes, all-oxide |

| Mining | low 1.1:1 strip ratio, minimal pre-strip, above water table |

| Metallurgy | 13 test programs, 75% average heap-leach gold recovery |

| Infrastructure | Water and water-rights obtained, nearby grid power, nearby highway access |

Sandy McVey, West Vault’s CEO, commented, “We are very pleased with the results of the Technical Report. Not only does it confirm that the project is strong economically, but more importantly it demonstrates how leveraged it is to the price of gold, going from 43% IRR in 2016 to 51% IRR now. This validates our thesis that our shareholders should benefit through their ownership of a high-quality project in an excellent jurisdiction and knowing that we will hold to our strategy of patiently letting the gold cycle do the work of increasing value, avoiding the risk of going to construction too early.”

Regarding expansion potential, there are a number of significant gold intercepts located proximal to current Mineral Resources, on strike from and below the proposed open pits that are not incorporated into the Technical Report Mineral Resource model. These intercepts show the potential to increase and extend the known Mineral Resource on West Vault’s property.

The Technical Report estimates a modest initial capital of US$66M for the Phase 1 Three Hills Mine. The Phase 2 Hasbrouck Mine is estimated to cost US$123M, and this money is planned to come from free cash flow generated at the Three Hills Mine. The Technical Report does not include mineralized material at the Company’s Hill of Gold property located between Three Hills Mine and Hasbrouck Mine.

Project Highlights – (US dollars)

Notes:

- Gold equivalent calculations are made using the ratio of recovered silver / gold and metal prices.

- Silver production is averaged over the Hasbrouck mine life only.

- Difference between Funding and Capex from free cash flow from Three Hills Mine.

- World Gold Council – Adjusted Operating Costs include:

On-site mining and G&A, royalties and production taxes, permitting and community cost related to current operations,

3rd party smelting, refining and transport costs, stock-piles and inventory write-downs, site-based non-cash remuneration, operational stripping costs and by-product credits, - Other category includes royalties, production taxes, permitting, refining and by-product credit.

- World Gold Council All-in /Sustaining Costs includes:

Adjusted Operating Costs (above) plus corporate G&A, reclamation & remediation – accretion & amortization, expenditures sustaining exploration and study costs, capital exploration, capitalized stripping and sustaining capital. - World Gold Council All-in Cost include:

All-in Sustaining Costs (above) plus community, permitting and reclamation and remediation costs not related to current operations and non-sustaining exploration and study costs, capital exploration, capitalized stripping and capital expenditure. - The $1,790/oz gold price represents the three-year trailing average gold price at 17 January 2023.

Sensitivity to Gold Price

Outlook

West Vault is committed to maximizing shareholder value through its low-risk gold-in-ground strategy, which involves acquiring, advancing, and holding high-quality development gold projects in the best jurisdictions.

The reader is cautioned that a production decision might be made on the 2023 PFS and that the Company may proceed to production without completion of a feasibility study. There is an increased risk associated with making a production decision based on a Pre-feasibility Study.

Authors and Qualified Persons Statement

The Technical Report was authored by RESPEC and was prepared in conformance with National Instrument 43-101 - Standards of Disclosure for Mineral Projects (“NI 43-101”). Technical work, analysis, and findings were completed by Thomas L. Dyer, P.E., and Jeff Bickel, C.P.G. both of RESPEC, Reno, with contributions by Mark Jorgensen, SME, of JE&TS (metallurgy), Ryan Baker, P.E., of NewFields (civil and heap leach) and Carl Defilippi, SME, of KCA (process design). Each person is either a “Qualified Person” or an “Expert Relied Upon” under NI 43-101 and has reviewed and approved the information in this website presentation relevant to the portion of the Technical Report for which they are responsible. Each Qualified Person or Expert Relied Upon noted above has reviewed and approved the scientific and technical content in this website presentation relating to the Technical Report. West Vault will file the Technical Report on SEDAR in support of the technical disclosures made in this website presentation within 45 days.

Sample Preparation, Analyses, and Security

It is RESPEC’s opinion that the sampling, assaying, and security procedures used at Three Hills and Hasbrouck deposits follow industry standard procedures, and are adequate for the estimation of the current Mineral Resource and Mineral Reserve and for use in preparing the Technical Report.

Data Verification

RESPEC completed audits of the database, performed a site visit, reviewed quality assurance and quality control data and confirmed historic assays. After performing their review, they consider the assay data to be adequate for the estimation of the current Mineral Resource and Mineral Reserve and for use in preparing the Technical Report.

About RESPEC

Based in Rapid City, South Dakota, RESPEC is a global leader in diverse technologies and draws from a wide array of expertise, products, and services to deliver world-class solutions for business, mining, energy, water, natural resources, urban development, infrastructure, and enterprise services.

Qualified Person

Sandy McVey P.Eng., Chief Executive Officer and Chief Operating Officer for the Company, as a non-independent Qualified Person as defined in NI 43-101, has reviewed and approved the technical information disclosed on this website.

Hasbrouck Gold Project Mineral Resources

Mineral Resources are reported inclusive of Mineral Reserves.

| Hasbrouck Deposit Reported Mineral Resources* December 15, 2022, (0.007oz AuEq/ton Cutoff) |

|||||

|---|---|---|---|---|---|

| Class | K Tons | oz Au/ton | K oz Au | oz Ag/ton | k oz Ag |

| Measured | 6,987 | 0.019 | 134 | 0.39 | 2,752 |

| Indicated | 35,041 | 0.015 | 516 | 0.27 | 9,404 |

| M+I | 42,028 | 0.015 | 651 | 0.29 | 12,156 |

| Inferred | 5,161 | 0.011 | 56 | 0.19 | 986 |

| Three Hills Deposit Reported Mineral Resources* December 15, 2022, (0.005oz Au/ton Cutoff) |

||||

|---|---|---|---|---|

| Class | K Tons | oz Au/ton | K oz Au | |

| Indicated | 10,423 | 0.018 | 185 | |

| Inferred | 1,008 | 0.017 | 17 | |

Notes:

- All estimates of Mineral Resource have been prepared in accordance with NI 43-101 standards.

- Mineral Resource for the Hasbrouck deposit is estimated using a gold equivalent 0.007oz AuEq/ton cut-off grade inside an optimized pit shell that was created using a gold price of $1,850/oz gold and $22.75/oz silver, a mining cost of $2.39/ton mined, a processing cost of $4.81/ton processed, a lithologic- and depth dependent recovery equation provided by Mr. Mark Jorgenson, G&A cost of $0.36/ton processed, and a 2.38% NSR royalty (note the project cash-flow analysis uses 3-year trailing average prices of $1,790/oz gold and $22.50/oz silver as off January 17, 2023).

- The Hasbrouck gold equivalent cutoff grade utilizes the following formulas:

- Oz AuEq/ton = oz Au/ton + (oz Ag/ton x AuEqFactor)

- AuEqFactor = (Au Price / Ag Price) x (Au Recovery / Ag Recovery)

- Upper Siebert Formation: oz AuEq/ton = oz Au/ton + (oz Ag/ton x 0.0053)

- Lower Siebert Formation: oz AuEq/ton = oz Au/ton + (oz Ag/ton x 0.0027)

- Mineral Resource for Three Hills deposit is estimated using a 0.005oz Au/ton cut-off grade inside an optimized pit shell created using a gold price of $1,850 per ounce, a mining cost of $2.39/ton mined, a processing cost of $2.98/ton processed, a grade-dependent recovery equation provided by Mr. Mark Jorgenson, G&A cost of $0.42/ton processed, and a 2.38% NSR Royalty.

- Rounding as required by reporting guidelines may result in apparent discrepancies between tons, grades, and contained metal content.

- The Mineral Resource has been prepared by Jeff Bickel, C.P.G of RESPEC in conformity with CIM “Estimation of Mineral Resource and Mineral Reserve Best Practices” guidelines as required by Canadian Securities Administrators NI43-101. Mineral Resources are not Mineral Reserves and do not have demonstrated economic viability. There is no certainty that all Mineral Resources will be converted into Mineral Reserves. These Mineral Resource estimates include Inferred Mineral Resources that are considered too speculative geologically to have economic considerations applied to them that would enable them to be categorized as Mineral Reserves. It is reasonably expected that the majority of Inferred Mineral Resources could be upgraded to Measured or Indicated Mineral Resource with continued exploration.

- The effective date of the Mineral Resource Estimate is December 15, 2022.

- The Mineral Resource Estimate may be materially affected by geology, environment, permitting, legal, title, taxation, sociopolitical, marketing, or other relevant issues.

- RESPEC is not aware of political, environmental, or other risks that could materially affect the potential development of the Mineral Resources.

Hasbrouck Gold Project Mineral Reserves

Proven and Probable Reserves total 44.0 million tons containing 753,000 ounces gold and 10.5 million ounces silver as detailed below:

| Hasbrouck Gold Project Reserves, January 11, 2023, RESPEC (1, 2) | ||||||

|---|---|---|---|---|---|---|

| K tons Ore |

Grade (oz Au/ ton) |

K oz Au | Grade (oz Ag/ton) |

K oz Ag | ||

| Three Hills Mine Reserves | ||||||

| 0.005 opt Au cutoff |

Proven | - | - | - | - | - |

| Probable | 9,653 | 0.018 | 175 | - | - | |

| P&P | 9,653 | 0.018 | 175 | - | - | |

| Hasbrouck Mine Reserves | ||||||

| Variable cutoff grade (3) |

Proven | 6,130 | 0.021 | 126 | 0.417 | 2,558 |

| Probable | 28,239 | 0.016 | 452 | 0.281 | 7,946 | |

| P&P | 34,370 | 0.017 | 578 | 0.306 | 10,504 | |

| Total Hasbrouck Gold Project | ||||||

|---|---|---|---|---|---|---|

| Variable cutoff grade (3) |

Proven | 6,130 | 0.021 | 126 | 0.417 | 2,558 |

| Probable | 37,893 | 0.017 | 627 | 0.210 | 7,946 | |

| P&P | 44,023 | 0.017 | 753 | 0.239 | 10,504 | |

Notes:

- The estimation and classification of Proven and Probable Mineral Reserves have been prepared by Thomas L. Dyer, P.E., of RESPEC following CIM standards effective 17 January 2023.

- Mineral Reserves are estimated based on previously designed pits which have been validated using $1,750/oz gold and $21.50/oz silver (note the project cash-flow analysis uses 3-year rolling average prices of $1,790/oz gold and $22.50/oz silver)

- Three Hills Mine cutoff grade used for Mineral Reserves is 0.005 oz Au/ton and are based on a grade dependent recovery equation for gold provided by Mr. Mark Jorgensen

- Recgold = min(0.925, (0.1786 times ln (grade in opt) + 1.5203) – 0.0025)

- Hasbrouck Mine Mineral Reserves use a variable gold recovery based on material in Upper Siebert and Lower Siebert along with depth below topo

- Upper Siebert: Recgold = (0.0009 times (Depth below topo in feet)) + 0.3026 + 0.10

- Lower Siebert: Recgold = (0.0002 times (Depth below topo in feet)) + 0.6412 + 0.05

- Hasbrouck Mine Mineral Reserves silver recovery uses a constant 24% for Upper Siebert and 17% for Lower Siebert

- Hasbrouck Mine Mineral Reserves use a gross metal value (“GMV”) cutoff grade of $5.17/ton which includes the cost for processing and G&A

- Mineral Resources are reported inclusive of Mineral Reserves

- The Inferred Mineral Resource does not contribute to the financial performance of the project and is treated in the same way as waste

Glossary

NI 43-101 - National Instrument 43-101 Standards of Disclosure for Mineral Projects

k - thousand

koz - thousand ounces

NPV(5%) - net present value at a five-percent discount rate

IRR - internal rate of return

G&A - general and administrative (costs)

Compliance with NI 43-101 and Cautionary Statement on Mineral Resources and Reserves

The information on this website presentation has been summarized from the Technical Report and Updated Preliminary Feasibility Study: Hasbrouck and Three Hills Gold-Silver Project, Esmeralda County, Nevada – RESPEC, January 2023, currently being prepared by Thomas L. Dyer, P.E., and Jeff Bickel, C.P.G. of RESPEC, Reno, with contributions by Mark Jorgensen, SME, of JE&TS (metallurgy), Ryan Baker, P.E., of NewFields (civil and heap leach) and Carl Defilippi, SME, of KCA (process design). Each aforementioned person is a "Qualified Person" or a “Expert Relied Upon” under NI 43-101, is independent of West Vault and has reviewed and approved the information in this presentation, as of the time that the Technical Report was produced and as relevant to the portion of the Technical Report for which they are responsible. RESPEC has reviewed and verified the data disclosed in this website presentation to be in conformity with generally accepted CIM “Estimation of Mineral Resource and Mineral Reserves Best Practices” guidelines as of the time of the Technical Report as required by NI 43-101. For readers to fully understand the information in this website presentation, they should read the Technical Report when available on www.sedar.com or at www.westvaultmining.com in its entirety, including all qualifications, assumptions, and exclusions that relate to the information set out in this website presentation that qualify the technical information contained in the Technical Report. The Technical Report is intended to be read as a whole, and sections should not be read or relied upon when taken out of the context of the full Technical Report. The technical information in this presentation is subject to the assumptions, qualifications, and exclusions contained in the Technical Report.

Non-IFRS Reporting Measures

"Cash Costs", “All-in Sustaining Costs” and “All-in Costs” are not Performance Measures reported in accordance with International Financial Reporting Standards (“IFRS”). These performance measures are included because these statistics are key performance measures that management uses to monitor performance. Management uses these statistics to assess how the Project ranks against its peer projects and to assess the overall effectiveness and efficiency of the contemplated mining operations. These performance measures do not have a meaning within IFRS and, therefore, amounts presented may not be comparable to similar data presented by other mining companies. These performance measures should not be considered in isolation as a substitute for measures of performance in accordance with IFRS.

Forward-looking Information

This website contains forward-looking information or forward-looking statements (collectively, “forward-looking information”) within the meaning of applicable securities laws. Forward-looking information is typically identified by words such as: “will’, “believe”, “plans to”, “achieve”, “opportunity”, “expansion potential”, “high grade feeder”, “root potential”, high-grade underground potential”, “current potential”, “re-rating potential”, and similar expressions, or are those, which, by their nature, refer to future events. Forward-looking information in this presentation includes, without limitation, the statements regarding the ability to achieve the recoveries and the processing capacity of the mines; regulatory processes and permitting; estimates of gold or other minerals grades; anticipated costs, anticipated sales, project economics, the realization of expansion and construction activities and the timing thereof; production estimates and other statements that are not historical facts. Information concerning Mineral Reserve estimates and the economic analysis thereof contained in the Technical Report are also forward-looking information in that they reflect a prediction of the mineralization that would be have been encountered, and the results of mining it, if a mineral deposit had been developed and mined at the time of the Technical Report and the assumptions in the Technical Report had remained correct. Although West Vault believes that such timings and expenses as set out in this presentation are reasonable, it can give no assurance that such expectations and estimates will prove to be correct. The Company cautions investors that any forward-looking information provided by the Company is not a guarantee of future results or performance, and that actual results may differ materially from those in forward-looking information as a result of various factors, including, but not limited to, the state of the financial markets for the Company's equity securities, the state of the market for gold or other minerals that may be produced generally, significant increases in any of the machinery, equipment or supplies required to develop and operate a mine, a significant change in the availability or cost of the labor force required to operate a mine, a significant increases in the cost of transportation for the Company’s products, variations in the nature, quality and quantity of any mineral deposits that may be located, the Company's ability to obtain any necessary permits, consents or authorizations required for its activities, to raise the necessary capital or to be fully able to implement its business strategies and other risks associated with the exploration and development of mineral properties. The reader is referred to the Company's public filings for a more complete discussion of such risk factors and their potential effects which may be accessed through the Company's profile on SEDAR at www.sedar.com.

Cautionary Note to US Investors Regarding the Use of Mining Terms.

This website has been prepared in accordance with the securities laws in effect in Canada, which differ from the requirements of U.S. securities laws. Unless otherwise Indicated, all reserve estimates included in this presentation have been prepared in accordance with NI 43-101 and the Canadian Institute of Mining, Metallurgy, and Petroleum Definition Standards on Mineral Resources and Mineral Reserves (the “CIM Definition Standards”). NI 43-101 is a rule developed by the Canadian Securities Administrators which establishes standards for all public disclosure an issuer makes of scientific and technical information concerning mineral projects. Canadian standards, including NI 43-101, differ from the requirements of the U.S. Securities and Exchange Commission (the “SEC”) under subpart 1300 of Regulation S-K (the “SEC Modernization Rules”), and resources and reserve information contained herein may not be comparable to similar information disclosed by U.S. companies. The SEC Modernization Rules replaced the historical property disclosure requirements included in SEC Industry Guide 7. As a foreign private issuer the Company is not currently subject to the SEC Modernization Rules. The SEC Modernization Rules includes the adoption of terms describing Mineral Reserves and Mineral Resources that are “substantially similar” to the corresponding terms under the CIM Definition Standards. As a result of the adoption of the SEC Modernization Rules, the SEC now recognizes estimates of “Measured Mineral Resources”, “Indicated Mineral Resources” and “Inferred Mineral Resources”. In addition, the SEC has amended its definitions of “proven Mineral Reserves” and “probable Mineral Reserves” to be “substantially similar” to the corresponding CIM Definitions. U.S. investors are cautioned that while the above terms are “substantially similar” to CIM Definitions, there are differences in the definitions under the SEC Modernization Rules and the CIM Definition Standards. Accordingly, there is no assurance any Mineral Reserves or Mineral Resources that the Company may report as “proven Mineral Reserves”, “probable Mineral Reserves”, “Measured Mineral Resources”, “Indicated Mineral Resources” and “Inferred Mineral Resources” under NI 43-101 would be the same had the Company prepared the reserve or resource estimates under the standards adopted under the SEC Modernization Rules. U.S. investors are also cautioned that while the SEC recognizes “Measured Mineral Resources”, “Indicated Mineral Resources” and “Inferred Mineral Resources” under the SEC Modernization Rules, investors should not assume that any part or all of the mineralization in these categories will ever be converted into a higher category of Mineral Resources or into Mineral Reserves. Mineralization described using these terms has a greater amount of uncertainty as to its existence and feasibility than mineralization that has been characterized as reserves. Accordingly, investors are cautioned not to assume that any Measured Mineral Resources, Indicated Mineral Resources, or Inferred Mineral Resources that the Company reports are or will be economically or legally mineable. Further, “Inferred Mineral Resources” have a greater amount of uncertainty as to their existence and as to whether they can be mined legally or economically. Therefore, U.S. investors are also cautioned not to assume that all or any part of the “Inferred Mineral Resources” exists. Under Canadian securities laws, estimates of “Inferred Mineral Resources” may not form the basis of feasibility or pre-feasibility studies, except in rare cases. For these reasons, the Mineral Reserve and Mineral Resource estimates and related information in this presentation may not be comparable to similar information made public by U.S. companies subject to the reporting and disclosure requirements under the United States federal securities laws and the rules and regulations thereunder.